Payments Requests in QuickBooks® QBO Using RTP® and FedNow® for Instant Good Funds

How Request for Payments (RfP™) Enhances Real-Time Accounting in QBO

To transform how businesses

send and receive payments by integrating real-time

payment requests into QuickBooks® QBO, delivering

instant, irrevocable Good Funds with hosted payment

links and ISO 20022-compliant automation.

TodayPayments.com bridges the

gap between accounting automation and real-time banking.

Through QBO integration, ISO 20022 file support, and

hosted RfP™ pages, we provide businesses with complete

control over their cash flow—instantly and securely.

Real-Time Payment Certainty, Now

in QuickBooks® QBO

In today’s fast-paced financial

landscape, merchants can no longer afford to wait days

for payments to clear or chase unpaid invoices. With

Request for Payments (RfP™) powered by RTP® and

FedNow®, and seamlessly integrated into

QuickBooks® QBO, businesses now gain instant access

to irrevocable Good Funds—24/7, with no

chargebacks or delays.

Whether sending one-time or

recurring payment requests, merchants can upload

batch files in ISO 20022 format, automate AR

processes, and give payers flexible checkout options

through hosted payment pages. From POS to MOTO to

ecommerce, real-time payment rails now empower

merchants with certainty, flexibility, and full

reconciliation.

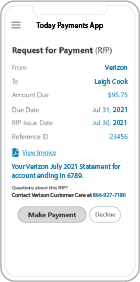

Payments Requests (RfP™)

allow merchants to request payment through hosted links

delivered by email, SMS, or invoices—enabling

customers to pay instantly via RTP® or FedNow® rails.

With full integration into QuickBooks® QBO, these

payments sync directly with invoices, accounts

receivable, and customer records.

Payment file uploads in ISO

20022 formats such as Excel, XML, and JSON

allow for batch processing of recurring or

one-time transactions, enabling merchants to get paid

faster with real-time certainty. Hosted pages ensure

a branded experience for payers, while reconciliation is

automated—no manual entry or guesswork required.

See

the features

QuickBooks® ACH, Cards, FedNow and Real-Time Payments

- Payment processing for all QuickBooks desktop, Pro, Premier, Enterprise and also QBO QuickBooks Online Our software is designed for simplicity and ease-of-use.

- ~ Automate Account Receivable Collection

- ~ Automate Account Payable Payments

- ~ One-time and Recurring Debits / Credits

Secure QB Plugin payment processing through QuickBooks ® specializes in the origination of moving money electronically.

Ask about our special:

Itemized RTP® Parameters, Attributes, Benefits

Core Parameters of Real-Time Payment Requests in

QuickBooks®

- Payment Rails: RTP® (The Clearing House),

FedNow® (Federal Reserve)

- Software Integration: QuickBooks® Online

(QBO)

- File Formats Supported: ISO 20022 (XML,

JSON, Excel)

- Settlement Speed: Real-Time (under 10

seconds)

- Transaction Types: A2A, B2B, C2B (Single or

Recurring Batches)

- Invoicing Options: SMS, Email, QR Code,

Embedded Invoice

- Hosted Page Delivery: Branded,

Mobile-Responsive, No Code

- Funds Type: Irrevocable Good Funds, Final

Settlement

- Compliance: NACHA & ISO 20022 aligned,

Bank-Agnostic

Key Features of Real-Time Payments for QBO Payees

1. Payee-Initiated RfPs with Hosted Checkout

Merchants initiate payment links via SMS, email, or

invoice. Customers receive a secure, mobile-optimized payment page to

complete the transaction instantly.

2. FedNow® and RTP® Compatibility

All RfPs are processed through real-time payment rails,

ensuring round-the-clock fund movement, even on weekends and holidays.

3. Alias-Based MID Assignment

Assign Merchant IDs to departments, team members, or

business units using email or mobile identifiers—enabling secure

reconciliation at scale.

4. ISO 20022 Messaging

Structured payment data supports complete remittance

metadata, compliant file uploads, and global messaging standards for batch

processing.

5. Hosted Payment Pages

Branded payment pages are embedded in each RfP™,

eliminating the need for custom development or API coding.

6. Automatic Ledger Sync with QuickBooks® QBO

Once funds are received, AR is automatically updated in

QBO, eliminating manual input, reconciliation errors, and aged receivables.

Ask us How:

- Payments Requests with hosted RfP™ links allow

QuickBooks® QBO users to collect real-time payments via FedNow® and RTP®

with no coding required.

- Batch upload ISO 20022-compliant payment files

in XML, Excel, or JSON to process hundreds of real-time A2A, B2B, or C2B

transactions instantly.

- Merchants can now initiate recurring payment

requests from QBO and receive Good Funds 24/7, eliminating chargebacks

and settlement uncertainty.

- Real-time payments integrate directly into your

QBO chart of accounts—improving financial reporting, audit trails, and

AR tracking.

- Whether your business processes payments via

ecommerce, POS, or MOTO, RfP™ requests with hosted payment pages provide

a frictionless, mobile-first experience for payers.

- TodayPayments.com gives QBO users the tools to

securely assign alias-based MIDs across locations or users—ensuring

transaction integrity and division-level visibility.

- QuickBooks® merchants can now send payment

requests via SMS and email that connect to a hosted page—allowing

customers to choose between RTP®, FedNow®, ACH, cards, and BNPL.

- Real-time payments settle in seconds,

automatically recorded in QuickBooks®, and eliminate aged invoices with

AR automation built in.

Why Businesses Choose TodayPayments.com for

Real-Time QBO Payments

- Enable payee-initiated RfPs using ISO 20022 batch

files

- Accept payments via FedNow®, RTP®, ACH, Cards, or

BNPL

- Automate invoice reconciliation directly into

QuickBooks®

- Use hosted pages—no development or coding required

- Assign alias-based MIDs to departments or agents

- Support for mobile invoicing, SMS links, and

recurring payments

- Apply, onboard, and activate online—no branch

visits needed

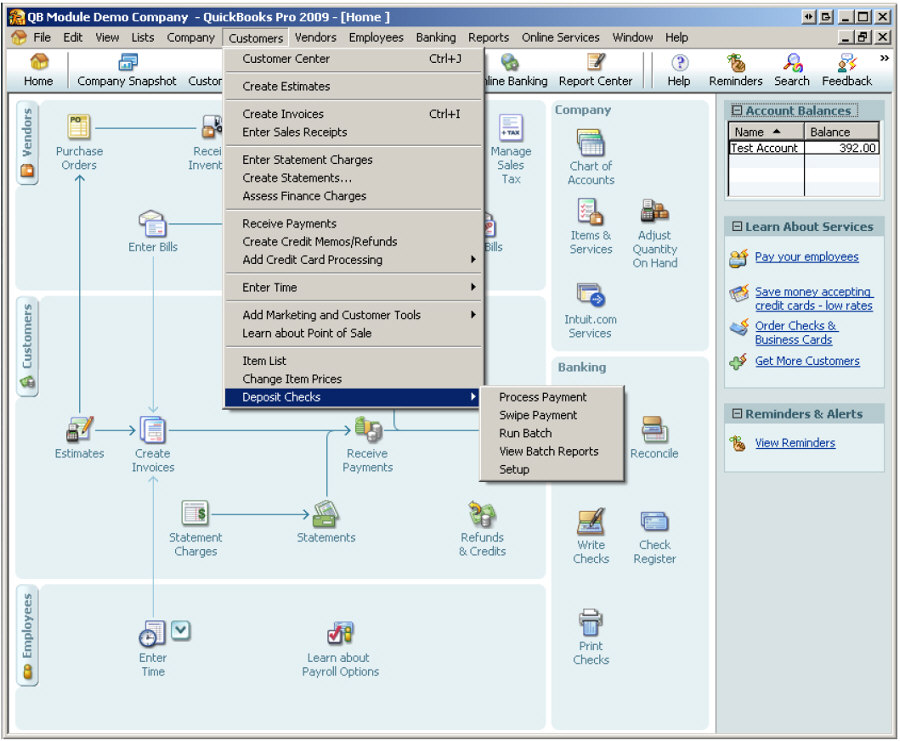

To utilize QuickBooks Enterprise and QuickBooks Online (QBO) for recurring periodic "Payments Requests" using Open Banking (VRP) with FedNow and Real-Time Payments, follow these steps:

Step-by-Step Guide

1. Integrating QuickBooks with FedNow and RTP

Ensure both QuickBooks Enterprise and QBO are integrated with services that support FedNow and RTP. SecureQBPlugin.com is an example of such a service.

2. Authorize VRP with Customer Banks

- Customer Mandate: Customers need to authorize VRP with their banks, specifying limits on the payment amount, frequency, and purpose.

- Documentation: Provide customers with necessary documentation and support to set up VRP.

3. Setting Up Recurring Invoices in QuickBooks

For QuickBooks Enterprise:

- Create a Memorized Transaction:

- Go to Customers > Create Invoices.

- Fill in the invoice details.

- Click Edit > Memorize Invoice.

- Set the invoice to recur at your desired frequency.

- Track and Reconcile:

- Use the Customer Center to track invoices.

- Reconcile payments through the Banking section.

For QuickBooks Online:

- Create Recurring Transactions:

- Go to Gear Icon > Recurring Transactions.

- Click New and select Invoice.

- Set the type to Recurring.

- Fill in the details and specify the interval.

- Track and Reconcile:

- Use Sales > All Sales to track invoices.

- Reconcile payments through the Banking section.

4. Automating Payment Requests

Use SecureQBPlugin or a similar service to automate sending payment requests:

- Configure Plugin: Set up the plugin to send payment requests according to the recurring invoice schedule.

- Match Payments: Ensure the payment requests match the variable amounts specified in the invoices.

5. Handling Variable Recurring Payments

- Dynamic Amounts: Adjust the recurring invoice amounts as needed based on the service or product provided.

- Notifications: Set up automated notifications for customers about payment requests and status updates.

6. Ensuring Security and Compliance

- Data Security: Ensure all transactions are encrypted and comply with financial regulations.

- Compliance: Verify that your payment solution and banking partner comply with FedNow and RTP regulations.

7. Customer Support and Communication

- Support: Provide customer support for setting up VRP and handling any issues.

- Communication: Send clear instructions and notifications to customers regarding their payments.

Implementation Example

- Integrate SecureQBPlugin with both QuickBooks Enterprise and QBO.

- Authorize VRP with customers’ banks.

- Create Recurring Invoices:

- QuickBooks Enterprise: Memorize the transaction with the set frequency.

- QBO: Set up recurring transactions with the specified interval.

- Automate Payment Requests:

- Configure SecureQBPlugin to handle automated payment requests.

- Track and Reconcile Payments:

- Use the respective tracking and banking features in QuickBooks Enterprise and QBO.

- Ensure Security and Compliance:

- Use encryption and comply with all financial regulations.

- Provide Customer Support:

- Offer detailed support and clear communication.

Ready to turn every QuickBooks® invoice into

real-time revenue? Want 100% Good Funds with no chargebacks, delays, or

accounting friction?

At

TodayPayments.com,

we help businesses like yours integrate Payments Requests (RfP™) with

QuickBooks® QBO—so you can:

✅ Send batch and recurring RfPs

✅

Get paid instantly via RTP® and FedNow®

✅

Use ISO 20022 files (.XML, JSON, Excel)

✅ Deliver secure,

hosted payment links

✅ Sync with QBO automatically

✅ Eliminate aged receivables

👉 Visit

TodayPayments.com

to launch real-time Payments Requests through QuickBooks® now.

Real-Time Payments. Real-Time Books. Real Good Funds.

By following these steps, you can efficiently manage recurring variable payments using the latest real-time payment technologies in both QuickBooks Enterprise and QuickBooks Online.

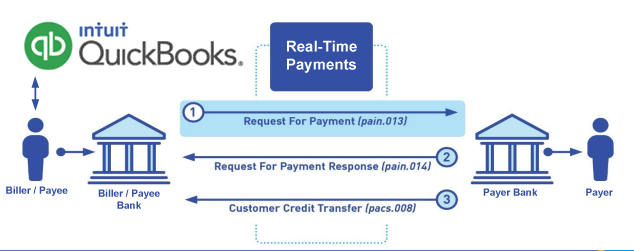

Call us, the .csv, text messaging and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) show how to implement Create Real-Time Payments Request for Payment File up front delivering message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continuing through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

Call us, the .csv, text messaging and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) show how to implement Create Real-Time Payments Request for Payment File up front delivering message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continuing through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

Our in-house QuickBooks payments experts are standing ready to help you make an informed decision to move your company's payment processing forward.

Pricing with our Request For Payment Professionals

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Using your invoice information database to create an existing Accounts Receivable file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file. Use either the Routing Number and Account Number for your Customers or use "Alias" name via Mobile Cell Phone and / or Email address.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee. We add your URI for each separate Payer transaction for additional Payment Methods on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Add integrating QuickBooks Online "QBO" using FedNow Real-time Payment using our Payments Requests system.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.